I launched this blog so I could share what I learned about real estate, and I just learned that some of the accepted practices in real estate are nuttier than you could imagine.

More specifically, I am referring to tax liens. Compared to tax deeds, how tax liens are handled is just nuts.

So as you probably know, local governments in the USA often generate revenue via property taxes on both real estate and vehicles. If you don’t pay your taxes, the government usually uses one of two ways to collect the funds.

One is tax deed, and the other is tax lien. This map will show you which states use which process.

In some states such as Virginia, the government will take the property and auction it off. The winning bidder will get what’s known as a tax deed, the government will get its money, and the former owner will (usually) get any proceeds from the auction after the taxes are paid.

This is a relatively straightforward process when compared to how the state of West Virginia handles unpaid real estate taxes.

Here in WV, real estate taxes are handled on the county level, and if you don’t pay the taxes for a given year, the county will auction off a tax lien. Basically, they will let someone else pay your taxes, and if you don’t pay them back after a certain amount of time then that second party will be able to get the county to issue a deed for the property in question.

This process is rather slow when compared to a tax deed auction. To give you an example, let’s take Kanawha County.

Their tax bill goes out on 15 July. If the bill for say 2018 doesn’t get paid by November 2019 (the auction is usually in November), the county will auction off a tax lien. (The state is going to handle the auctions from here on out, but the steps are the same.) In addition to the 2018 taxes, the winner of the auction will be expected to pay the 2019 taxes as well, assuming they are still outstanding.

In our example, the property owner has until 31 March 2021 to redeem the lien (pay the overdue taxes, and also pay processing fees), and if they don’t then the holder of the lien can get a deed from the county.

Whoever bought the lien will be the new owner – usually. The reason I say usually is that there are several interesting quirks to this process.

For example, it’s not uncommon for the county to auction off a tax lien on a property for unpaid 2018/2019 taxes to one person, and then auction off a lien on that same property for unpaid 2020 taxes to someone else. The second lien is on taxes from before the first lienholder owns the property, so you would think that the first lienholder would not be responsible for paying them, but you would be wrong.

If the first lienholder doesn’t all the taxes (including the taxes owed from before the first lienholder takes ownership), the second lienholder can get a deed from the county.

You see, in West Virginia, owners do not owe real estate taxes. Instead, the property itself owes the taxes. This is not what the law says, but it is how things actually work.

But wait, there’s more.

The county isn’t always able to sell a tax lien, so what they will do is auction it off the next year. And then the year after that. And the year after that.

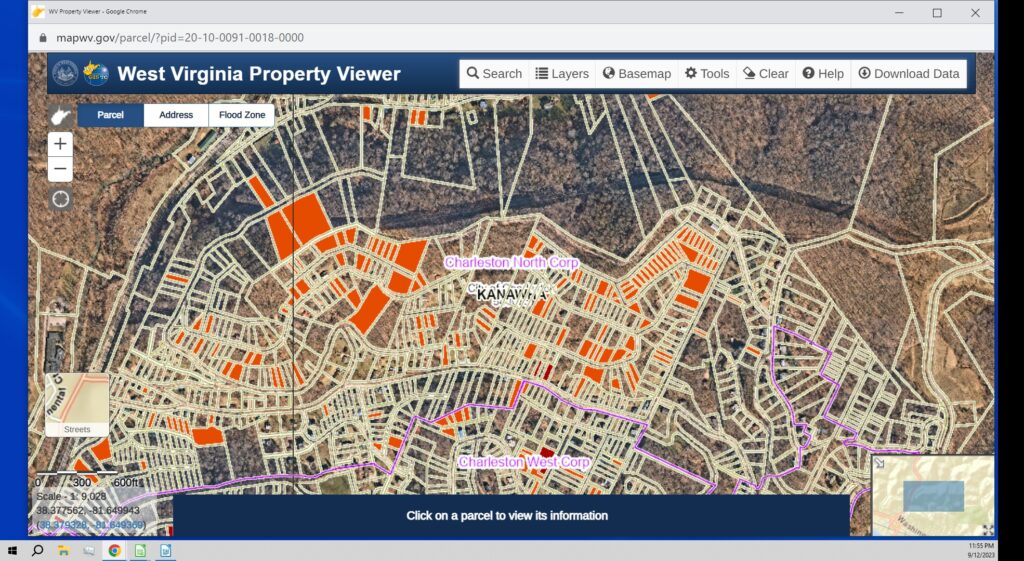

There are properties with past due taxes which have been delinquent for as much as a decade because no one wants to pay them. For example, this map from the WV State Auditor’s Office shows a subdivision just a few minutes outside of Charleston. All of the properties in orange are delinquent on their taxes, and some of them have been delinquent for years.

You could have a country estate on some of these lots.

I could not tell you why the taxes have gone unpaid for so long, but it does say something about the real estate market in West Virginia. There’s more land available than there are people who want to buy and build.

Anyway, I just found this interesting, and wanted to share.

0 Comments